Next Generation Decision Making.

Powered by AI.

Business happens at digital speed. For business leaders and investors, identifying opportunities, responding to shifts and preventing surprises has never been more difficult. Ongoing market, geopolitical and technology shifts intensify this complexity. Despite having more information, the process of identifying opportunities, responding to shifts and mitigating threats remains expensive and time-consuming.

The Espalier Decision Engine

The Espalier platform combines search, artificial intelligence, granular industry taxonomies and business signals to create contextual knowledge for strategic decision-making. We help business leaders, investors, bankers and corporate development teams better understand their place in the business ecosystem, improve situational awareness, see around corners and act with conviction.

We Specialize in Four Areas

Solutions

See yourself – and your ecosystem – in the right context.

Espalier’s market intelligence platform is the foundational capability for how corporate and business unit strategies are formulated, tested and refined. We create a 360 degree view of an industry or market segment across a range of dimensions: key players (customers, prospects, competitors), product, technologies, suppliers, partners, locations, commodities and raw materials. We provide three essential modules which can be used separately or together — all in service of strengthening your strategic baseline.

Market Intelligence Solution Modules

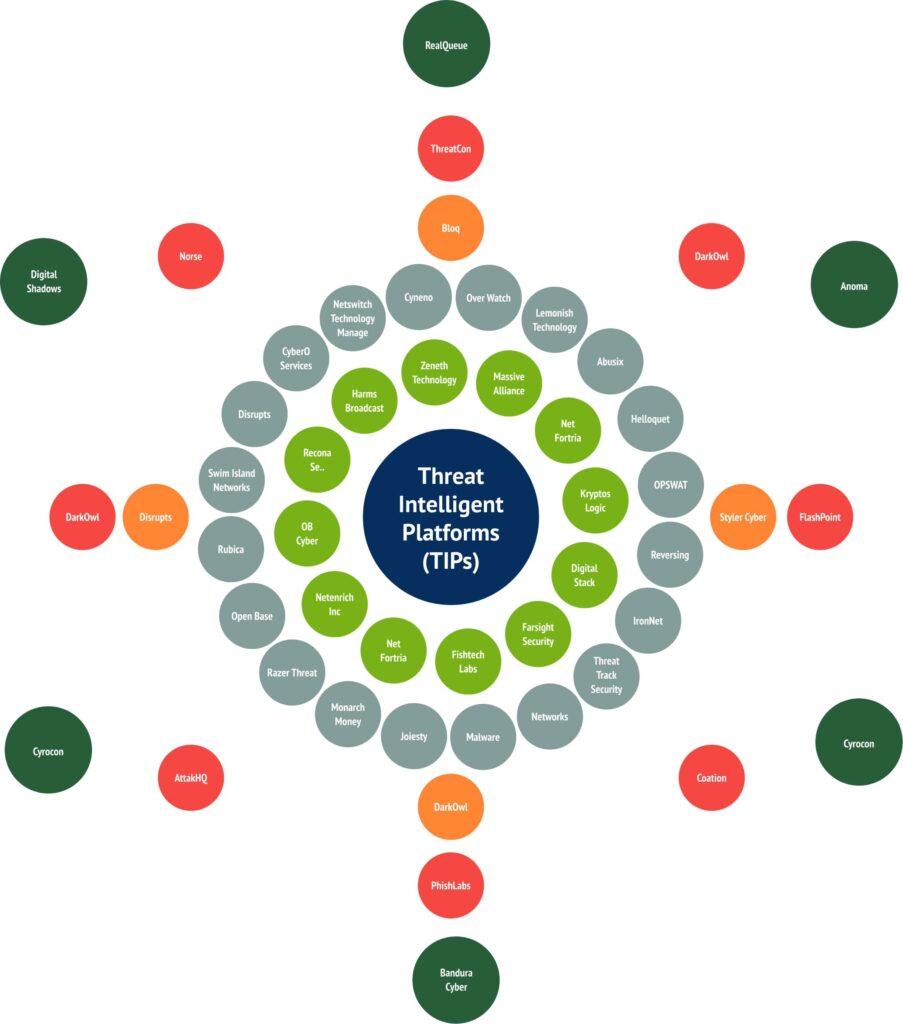

1. Industry Maps / Market Landscapes

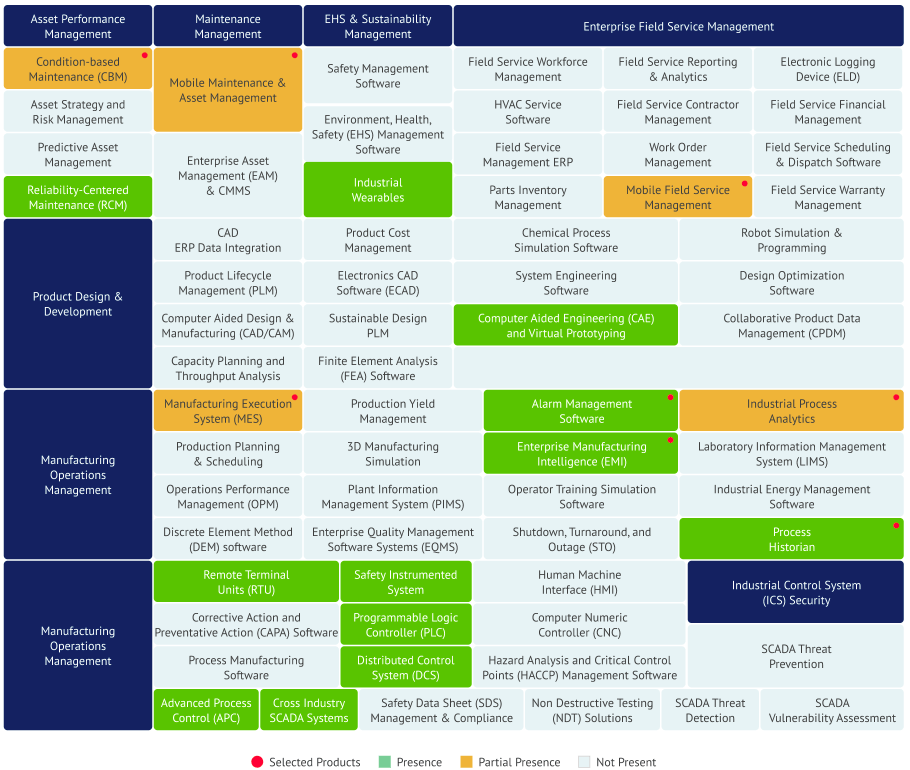

Espalier’s Industry Mapping and Market Landscaping Modules create granular views of industries and markets. Organizing principles like value chains or technology stacks help describe the key players, what they do and how they are positioned.

Our proprietary algorithms and taxonomies accelerate the process of creating industry logic and context. This in turn enables faster formulation of strategic choices for business decision-makers.

Important Questions

• How should I define my industry? • Where do I sit within my industry? • How do I define and visualize the industry value chain and its tech stack? •

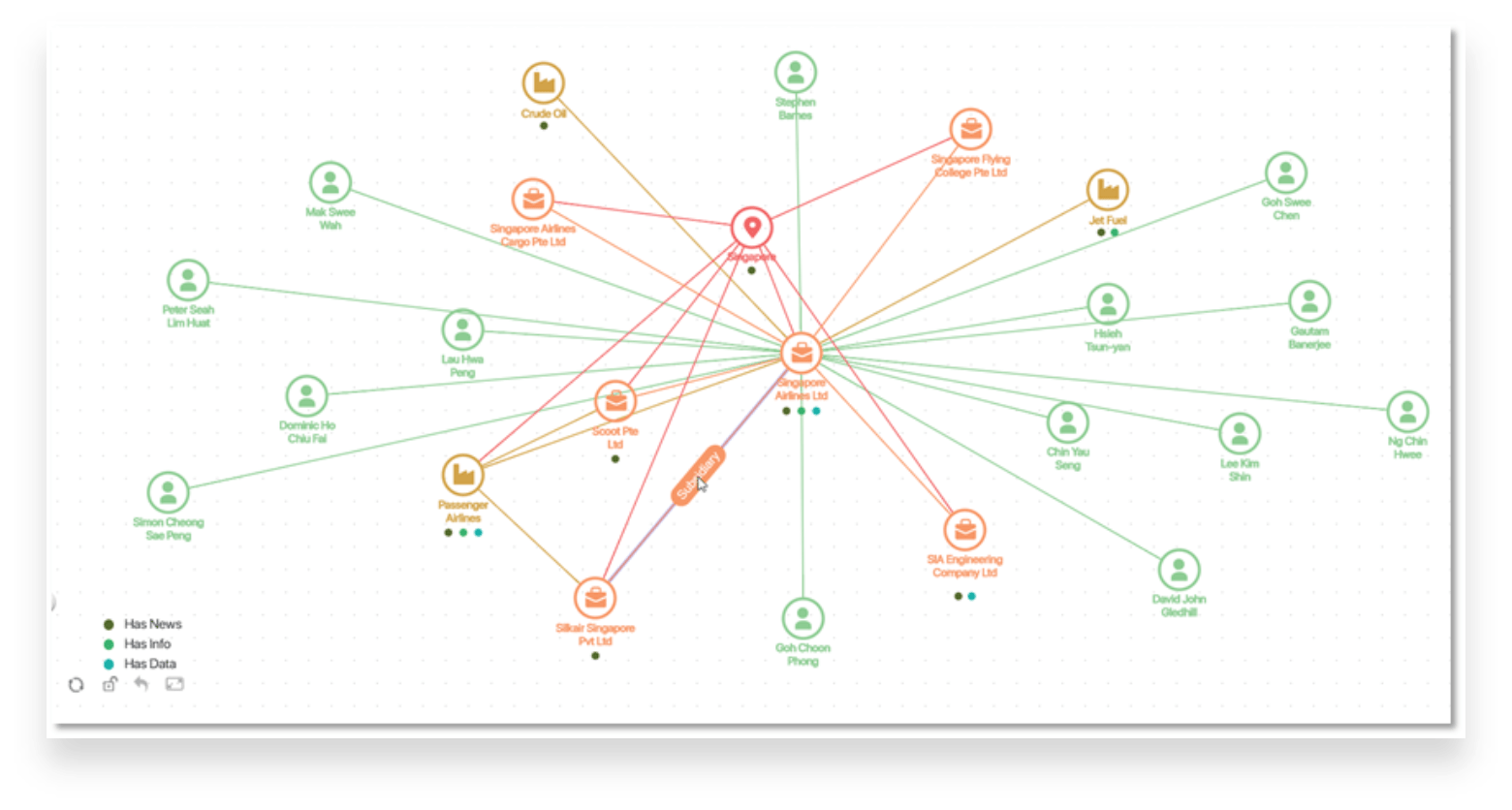

2. Business Eco-system Analysis

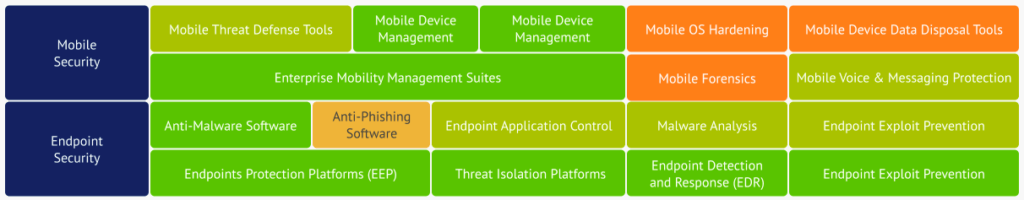

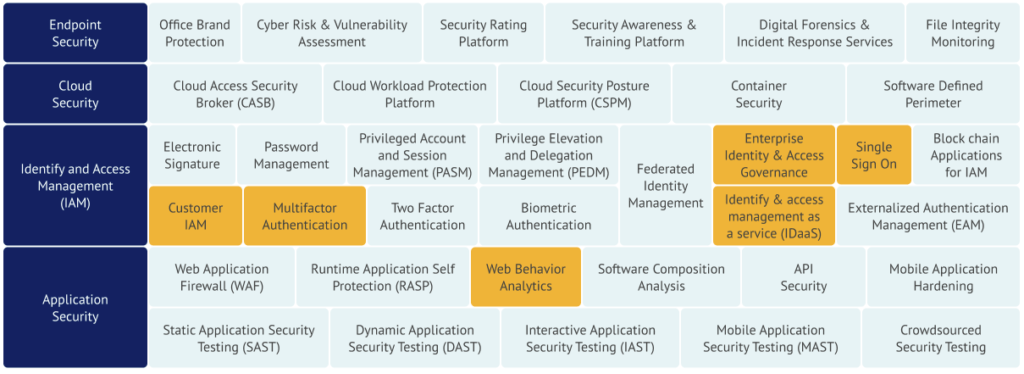

The Business Eco-system Analysis module maps a company’s product and service portfolio against prevailing industry taxonomies. This yields a distinctive data-set for evaluating industries and companies.

Important Questions

• How should I define my industry? • Where do I sit within my industry? • How do I define and visualize the industry value chain and its tech stack? •

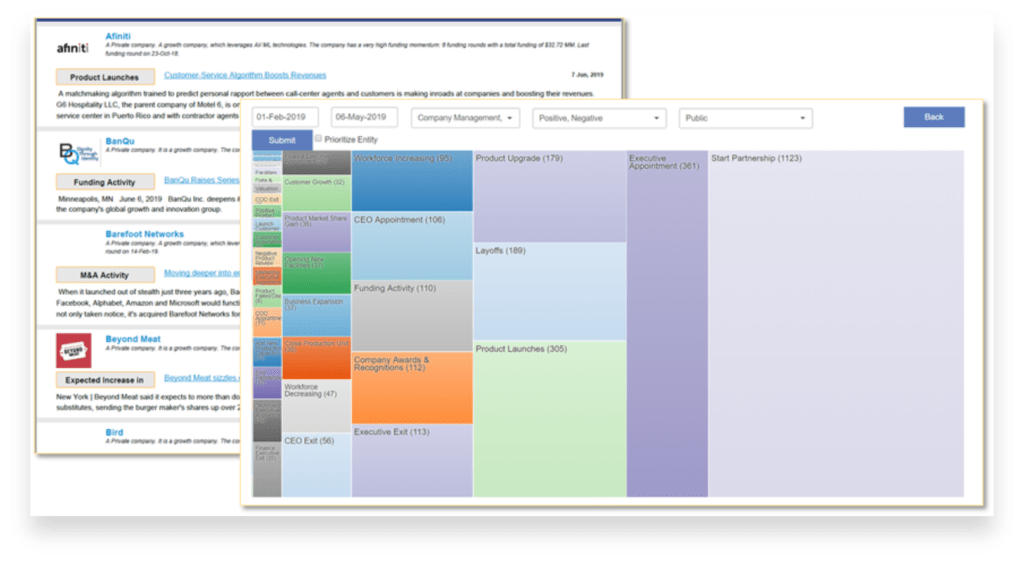

3. Business Signals

Detecting business signals is vital to maintaining competitive advantage. Our Business Signals module covers 500+ industry segments, companies, locations and commodity signals in real-time. With contextualized insights, decision-makers can accelerate and sharpen their responses to market stimuli.

Important Questions

• What important market, political, social, regulatory, environmental signals should I be listening to? What are these telling me? • What signals can I detect from my competitors, partners, suppliers and customers? • How should I respond? •

Finding the Right Needles in Larger Haystacks.

Whether companies are looking to partner, invest or acquire – sharper clarity on strategic gaps is essential for identifying highly targeted assets for your portfolio.

Espalier’s M&A intelligence platform finds portfolio matches by considering hundreds of variables for strategic and financial fit. Predictive capabilities on future funding sources and M&A help investment banks, private equity firms and corporate development teams make decisions on what’s ahead versus past trends. Espalier’s three M&A modules can be used separately or in combination to create a distinct advantage in your M&A activity.

Mergers and Acquisitions Solution Modules:

1. Sourcing

Our M&A Sourcing Module places companies on contextualized maps for understanding areas of strength, weakness and critical gaps — shortening the cycle required to develop target lists of potential acquisitions.

In a sell-side context, we dissect gaps in a company’s portfolio and determine those assets for highest consideration.

Important Questions

• What are important gaps in my portfolio? • Who should I buy? • Why should I buy them? •

2. Strategic Diligence

Once an asset is identified, information complexity and uncertainty can constrain and delay the strategic diligence process. Our Strategic Diligence Module helps firms devote more time on the assessment, capability and growth potential of key assets.

Important Questions

• Who are the players in my industry and eco-system? Traditional, emerging, nascent. • How do they compete? • What are important relationships? •

3. Value Creation

Post-acquisition, the Value Creation Module provides clients with opportunities for real-world improvements in the top-line and bottom line.

Value creation requires precise management of the entire merger process – from preparation to integration. This includes robust strategy, deal assessment and clarity of M&A methodology.

Important Questions

• How do I improve the assets to achieve my business case? • How do I identify bolt-on opportunities? • How do I prepare for the most optimal exit? •

See Threats, Risks and What is Under the Surface.

Volatility creates operational and financial consequences for businesses. Our Enterprise Risk solution evaluates business ecosystems from an expanding set of dimensions, including: suppliers (tier 2-3), regulatory environment, and demand patterns. Our analysis helps business leaders “see around corners”, proactively plan and mitigate potential risk. Our two Enterprise Risk Modules can be used separately or together as a means to modernize your risk assessment capabilities.

Enterprise Risk Solution Modules

1. Supply Chain Risk Assessment

The Supply Chain Risk Assessment module helps understand and assess physical, operational or logistical risk across the supply chain. We identify vulnerabilities, quantify their impact and determine mitigating alternatives to prevent disruption.

Important Questions

• Can I monitor the participants in my supply chain in real time? • Can I react to external events impacting my supply chain? • Can I find alternatives to my current supply chain to mitigate risk?

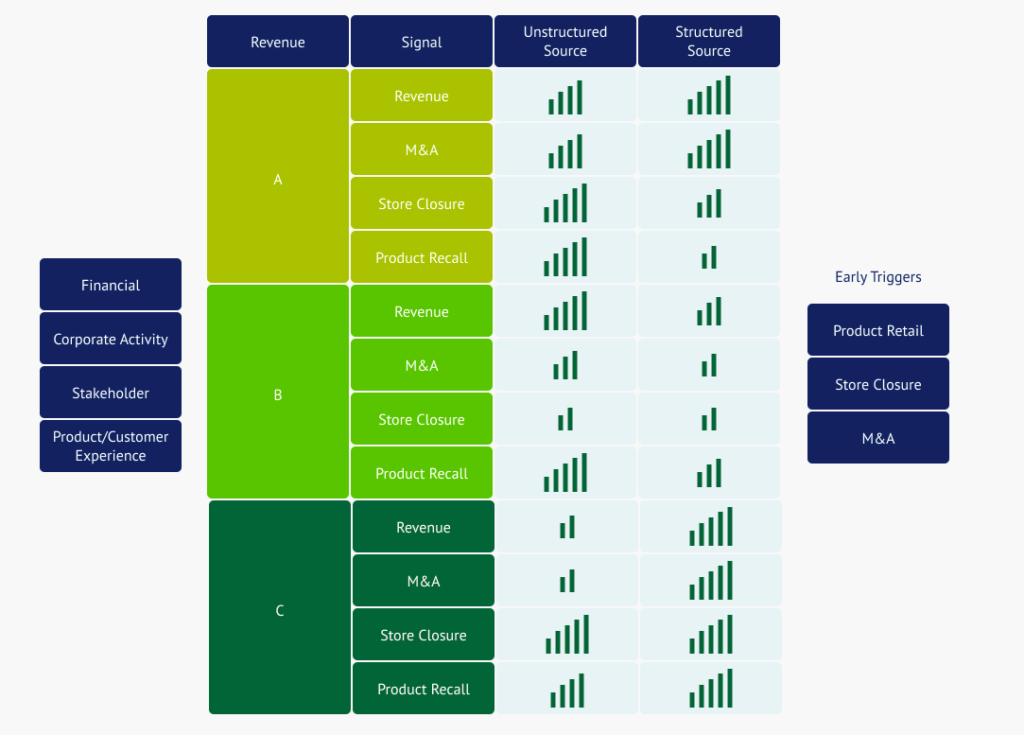

2. Early Warning

COVID-19 taught us that certain major events initially emerge as weak signals. By the time the signal is discernible, operational options become constrained. Our Early Warning Module helps protect operating freedom by identifying emerging business signals with strategic significance. For example, shifts in a supplier base or location could foreshadow a potential supply risk.

The Early Warning module is based on two requirements, correctly identifying actual events, and placing these events into context through a comprehensive view of the business environment and industry landscape.

Important Questions

• What signals should I monitor to identify emerging enterprise risks and opportunities? • How can I capitalize risks faced by my competitors to create strategic advantage? • How can I identify new, urgent dimensions of my enterprise risk model?

Expand Possibilities for Organic Growth.

Achieving organic through innovation and more effective commercial execution remains an elusive goal for many mature companies. Our Growth and Innovation modules help corporate strategy, product management, and business development leaders identify opportunities for product development, market development and digital transformation. The three Growth and Innovation modules can be consumed together or separately to accelerate and elevate the identification of next generation growth opportunities.

Growth and Innovation Solution Modules:

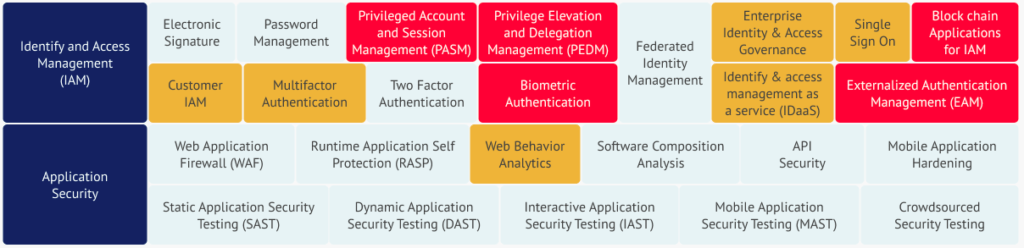

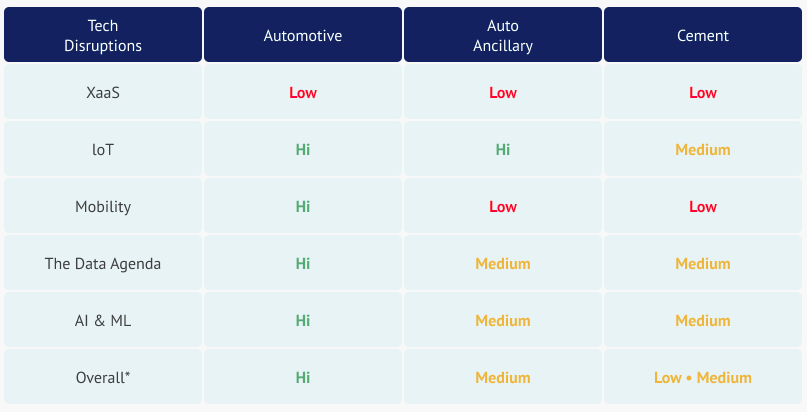

1. Digital Transformation

Every company is confronting the need to transform it’s enterprise operating model into a digital model. The Digital Transformation Module explores technology convergences, funding and acquisition patterns to help corporate strategists identify technologies and business models that are poised to create disruptions to the existing order.

Important Questions

• What emerging technologies should I be tracking? • Which have potential to create disruption or opportunity? • How should customer value propositions evolve as a result? •

2. Innovation and Offering Strategy

Product management leaders must continuously explore their landscape to define and refine their product/offering roadmap. Our Innovation and Offering Strategy Module provides analysis of competitive benchmarking, adjacent spaces, critical gaps, etc. yielding specific insights on what to build (or buy) and how to best position these offerings within the marketplace.

Important Questions

• What are new and emerging product segments in my industry? • How do I benchmark relative to my competitors? • What are key gaps in my existing product line or product experience? •

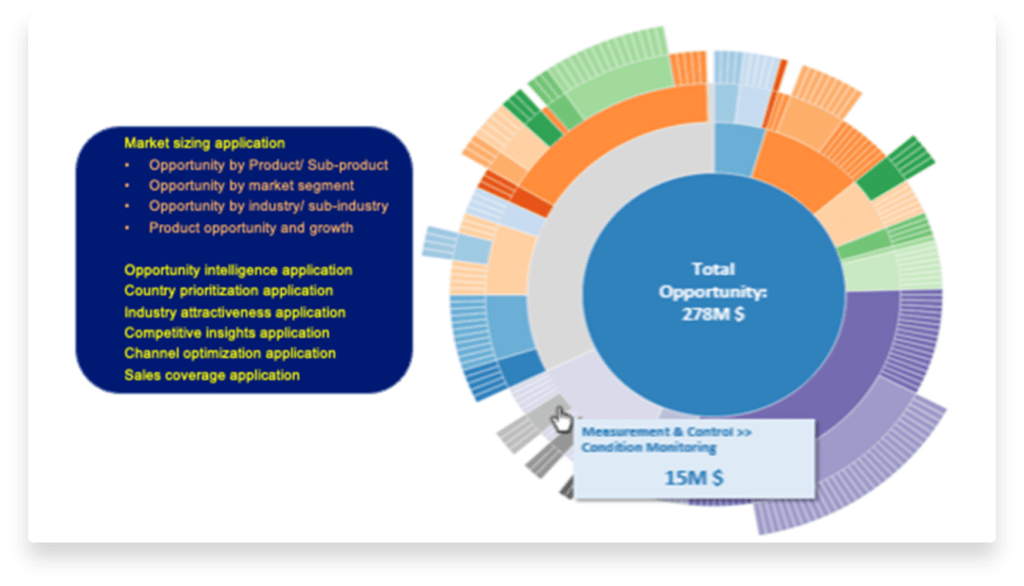

3. Market Development

Finding new opportunities for selling and market development require credible data and insights into segment (or account) size and growth potential, competition, and pricing flexibility – to name a few. The Market Development Module provides market development executives with the territory and/or industry level insight to drive customer acquisition and retention in support of organic growth.

Important Questions

• How can I expand my share of wallet with enterprise customers? • What events will drive new account demand going forward? • How can I benefit from near real-time sales intelligence to win more and grow market share? •